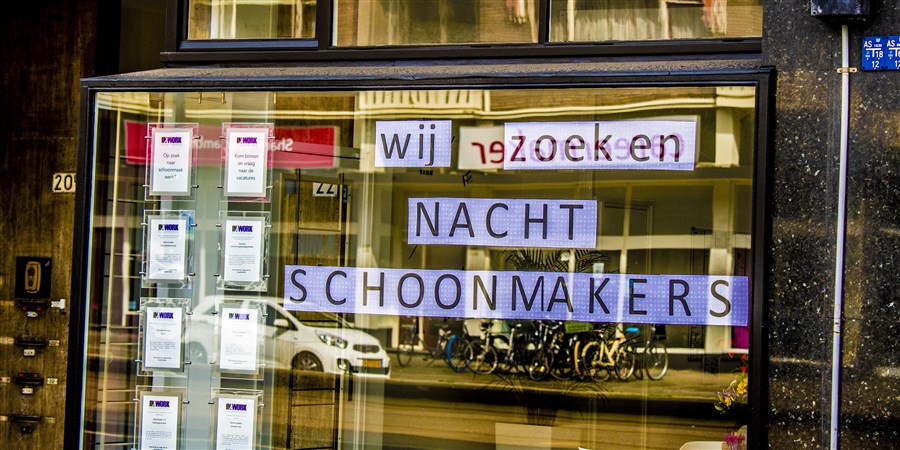

One-quarter of businesses facing staff shortages

Since mid-2018, approximately one-quarter of the non-financial private sector have cited staff shortages in the Business survey. The number of businesses encountering impediments as a result has not declined as of Q3 2019. Nevertheless, on balance 12 percent of entrepreneurs anticipate an increase in their workforce over Q3. This share is lower than in the same quarter last year, when on balance 18 percent of entrepreneurs expected such as increase.

| Year | Quarter | Enterprises facing staff shortages (%) |

|---|---|---|

| 2016 | Q1 | 4.6 |

| 2016 | Q2 | 5.4 |

| 2016 | Q3 | 6.7 |

| 2016 | Q4 | 8.3 |

| 2017 | Q1 | 8.7 |

| 2017 | Q2 | 10.4 |

| 2017 | Q3 | 15.6 |

| 2017 | Q4 | 16.5 |

| 2018 | Q1 | 18.4 |

| 2018 | Q2 | 20 |

| 2018 | Q3 | 25.2 |

| 2018 | Q4 | 25.9 |

| 2019 | Q1 | 24.1 |

| 2019 | Q2 | 24 |

| 2019 | Q3 | 24.9 |

| Source: CBS, KVK, EIB, MKB-Nederland and VNO-NCW | ||

Most severe shortage found in business services

In the business services industry, staff shortages are affecting 35 percent of entrepreneurs. The share of entrepreneurs with staffing deficits lies at 32 percent in the transport and storage industry. Staff shortages are also above average in the industries information and communication, accommodation and food services and construction. In mining and quarrying, however, only 5 percent report labour shortages.

| Bedrijfstak | Q3 2019 (%) | Q2 2019 (%) |

|---|---|---|

| Non-financial private sector | 24.9 | 24 |

| Business services | 35.4 | 33.9 |

| Transport and storage | 32.2 | 28.9 |

| Information and communication | 31.1 | 31.2 |

| Accommodation and food services | 29.1 | 29.4 |

| Construction | 27.3 | 26.5 |

| Manufacturing | 21.4 | 19.3 |

| Car trade and repairs | 21.4 | 22.3 |

| Wholesale and commission trade | 18.4 | 18 |

| Real estate, renting and business activities | 17.8 | 17.6 |

| Retail trade (excl. cars) | 12.2 | 12.7 |

| Mining and quarrying | 5.5 | 8.5 |

| Source: CBS, KVK, EIB, MKB-Nederland and VNO-NCW | ||

Entrepreneurs still positive

Business confidence stood at 10.6 at the start of Q3, representing a decline by 1.4 points on Q2. Despite this decline, the mood among entrepreneurs remains positive with the sentiment indicator far above the average since monitoring started in 2008 (2.0). Optimism has prevailed in the private sector since October 2014.

Information and communication most optimistic

Business confidence is highest in the information and communication industry, where It rose sharply from 17.9 in Q2 to 25.0 in Q3. In the previous eleven quarters, the most positive mood was consistently found among entrepreneurs in construction. This confidence declined to 20.6 in Q3 2019, however. Entrepreneurs in car maintenance and repair services reported a negative mood for the third quarter in a row. Their confidence in Q3 came out at -12.7, which means it deteriorated against the previous quarter (-5.3).

| Bedrijfstak | Q3 2019 | Q2 2019 |

|---|---|---|

| Non-financial private sector | 10.6 | 12 |

| Information and communication | 25 | 17.9 |

| Construction | 20.6 | 27.8 |

| Business services | 15.3 | 13 |

| Wholesale and commission trade | 12.9 | 13.4 |

| Transport and storage | 10.3 | 8.4 |

| Mining and quarrying | 8.9 | -1 |

| Retail trade (excl. cars) | 7.6 | 10.9 |

| Accommodation and food services | 7.4 | 8.6 |

| Manufacturing | 3.9 | 6.7 |

| Real estate, renting and business activities | 1.5 | 7.2 |

| Car trade and repairs | -12.7 | -5.3 |

| Source: CBS, KVK, EIB, MKB-Nederland and VNO-NCW | ||

This is a joint publication by: