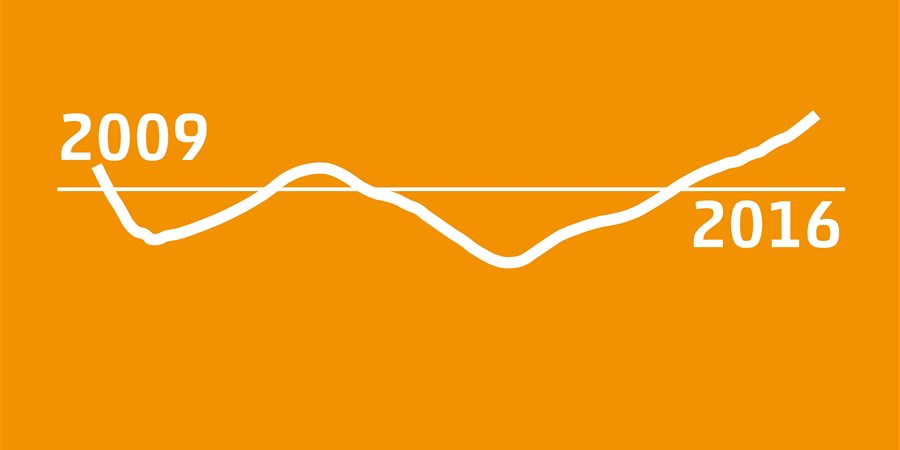

Economic situation improving steadily

Statistics Netherlands’ Business Cycle Tracer is a tool used to monitor the economic situation and economic developments. It uses fifteen key macro-economic indicators, which - together - provide a coherent picture of the state of the Dutch economy as published by CBS during the last month or quarter.

Manufacturers and consumers again more positive

The mood among Dutch consumers improved again in October and reached the highest level after August 2007. Consumers’ willingness to buy in particular improved and consumers are slightly more positive about the economic climate.

Confidence among Dutch manufacturers has also improved further, signalling recovery from the substantial setback in August. This is entirely due to the expected strengthening of economic activity. Both producer and consumer confidence are now above the level of their long-term average.

Investments, consumption and export of goods growing

The third quarter again showed considerable growth in investments related to transport equipment and residential property. Companies invested more in aircraft, lorries, semi-trailers and computers. However, corporate investments in passenger cars (leasing contracts) shrunk.

Consumer spending as well was higher in this year’s third quarter than last year’s. Consumers mainly spent more on services such as hotels and restaurants and recreation. Expenditure on services makes up more than half of total domestic consumption expenditure. In addition, consumers spent more on electrical applicances and on cars.

The increase in export of goods and services was slightly lower in the third quarter compared to the previous quarters of 2016. Re-exports (exports of previously imported products) grew around twice as fast as exports of Dutch products.

Dutch companies exported significantly higher volumes of chemical, mainly pharmaceutical, products year-on-year. Furthermore, exports of food products, (basic)metal products and machinery grew.

Manufacturing output continues to grow

The average daily output generated by Dutch manufacturing industry was 2.4 percent up in September 2016 from September 2015, a somewhat faster growth than in August. Over the past twelve months, manufacturing output has seen a continual rise above the level of the same month one year previously. Again, the sector transport equipment showed the highest output growth.

Number of bankruptcies stable

The number of bankruptcies was the same in October 2016 as in the preceding month. In September the number of bankruptcies went up by 12.

Labour market improves further

The number of jobs held by employees and self-employed rose by 26 thousand in Q3 2016. The number of temp jobs increased in particular. Employment also improved in the trade sector and the sector hotel and restaurants. The number of new job vacancies grew by nearly 7 thousand while the number of unemployed fell by 37 thousand.

In the third quarter of 2016, there were on average 9,999 thousand jobs. The number of jobs has grown for ten quarters in a row. Since the first quarter of 2014, altogether 250 thousand new jobs have been added. Relative to the third quarter last year, the total number of jobs in the Netherlands has increased by 95 thousand.

510 thousand people were jobless in September, bringing unemployment further down to 5.7 percent of the labour force. The unemployment decrease over the past three months averaged around 13 thousand per month.This decrease is most significant among the over-45s.

Year-on-year, unemployment is now lower by nearly 100 thousand, but it is still 200 thousand higher than in August 2008 before the onset of the economic crisis. Unemployment had then reached its lowest point in years, with 310 thousand.

The number of hours worked in temp jobs is rising again. In Q2 2016, it was up by 2.9 percent relative to Q1 2016. The number of temp hours fell by 1.4 percent in Q1, but increased in Q2 for both short-term and long-term temporary contracts.

Sustained economic growth

The Dutch economy continued to expand in the third quarter. According to the first estimate, quarter-on-quarter economic growth amounts to 0.7 percent. This is mainly due to rising exports and household consumption.The Dutch economy grew by 2.4 percent in Q3 2016 compared to the same quarter last year.

On Friday 23 December 2016, CBS will publish the second estimate on economic growth and employment in Q3 2016.