Higher government revenues reduce public deficit

The target set by the European Union stipulates that, calculated over the entire calendar year, the public deficit should not exceed 3 percent of GDP. The deficit over 2015 was 1.9 percent. The Netherlands Bureau for Economic Policy Analysis (CPB) estimates a budget deficit of 1.1 percent for 2016.

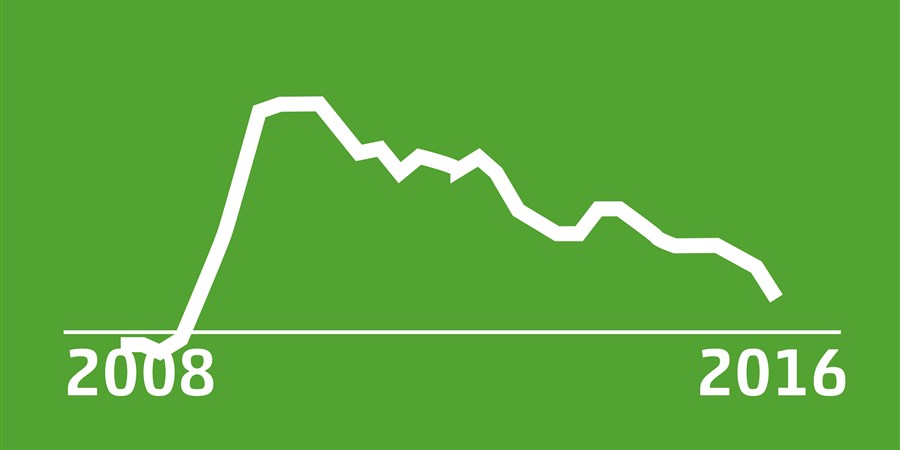

Public debt stood at 437 bn euros (63.7 percent of GDP) in mid-2016, i.e. 1.4 percentage points below the level at the end of 2015. The debt-to-GDP ratio declined further towards the EU target of 60 percent of GDP.

Public revenues continue to rise

Government revenues amounted to 299 bn euros on an annual basis, i.e. nearly 7 bn euros more than in 2015, mainly due to higher revenues from social contributions. Revenues from corporate tax and VAT also rose, but natural gas revenues declined. Public spending was almost the same as last year, totalling 305 bn euros.

Sale financial assets brings down public debt

Despite the deficit in the first half of 2016, the government achieved a public debt reduction by nearly 4 bn euros relative to the end of 2015. Debt was reduced by a return of 7 bn euros from transactions in financial assets, like the sale of ASR shares, revenues from termination of interest rate derivatives and public loan repayments. Revenues from transactions in financial assets do not affect the public deficit, but can be used for debt repayment.