Economic situation improves somewhat

Statistics Netherlands’ Business Cycle Tracer is a tool used to monitor the economic situation and economic developments. It uses fifteen key macro-economic indicators, which - together - provide a coherent picture of the state of the Dutch economy as published by CBS during the last month or quarter.

Manufacturers and consumers more positive

Confidence among Dutch manufacturers improved further in April reaching the highest level in five years. Manufacturers are more positive about their order books and stock levels.

Dutch consumer confidence also improved in April, following four months of decline. The mood among consumers has turned from negative to positive in April. They are much more optimistic about the economic climate. Their willingness to buy has also improved marginally. Producer and consumer confidence are both above the level of their long-term average.

Growing investments, household consumption and exports of goods

In Q1 too, investments in transport equipment and residential property increased considerably. Corporate investments in trucks, semitrailers, aircraft and other modes of road transport grew significantly. Companies also spent more on passenger cars, computers and software than one year previously.

The growth rate of exports was the same in Q1 2016 as in the preceding quarter, although exports of Dutch products grew less rapidly in the past quarter than re-exports, i.e. exports of products previously imported. The export of transport vehicles rose noticeably compared to one year ago.

Consumer spending was also up in Q1 relative to Q1 2015. Dutch consumers spent more in hotels and restaurants and on recreational and cultural activities. Spending on services accounts for more than half of total domestic consumer spending. Consumers also spent more on electric appliances, food products and home furnishings.

Growth manufacturing output slows down

The average daily output generated by Dutch manufacturing industry in March 2016 was 0.3 percent up from the same month last year. Growth is less substantial than in the preceding months. Output realised by the transport equipment industry and the food industry rose considerably in March, but output generated by the pharmaceutical products slumped.

Fewer bankruptcies

The number of business failures declined by 15 in April 2016 relative to the preceding month. In March the month-on-month decline was 88. Most bankruptcies were filed in the trade sector.

Marginal decline jobs, increase job vacancies

The number of jobs of employees and self-employed fell by 12 thousand in Q1 2016 compared to Q4 2015. Many jobs were lost in the care sector, but the number of new job vacancies grew by nearly 8 thousand and unemployment decreased by 24 thousand.

The job market declined marginally for the first time in two years. Previously, employment had grown for seven quarters in a row. Compared to Q1 2015 the number of jobs was nearly 100 thousand higher.

The total number of hours worked in temp jobs grew by 3.6 percent in Q4 2015 relative to Q3, the sharpest increase in five years. The increase was recorded in long-term temporary employment contracts in the form of secondment or pay-rolling as well as in short-term contracts.

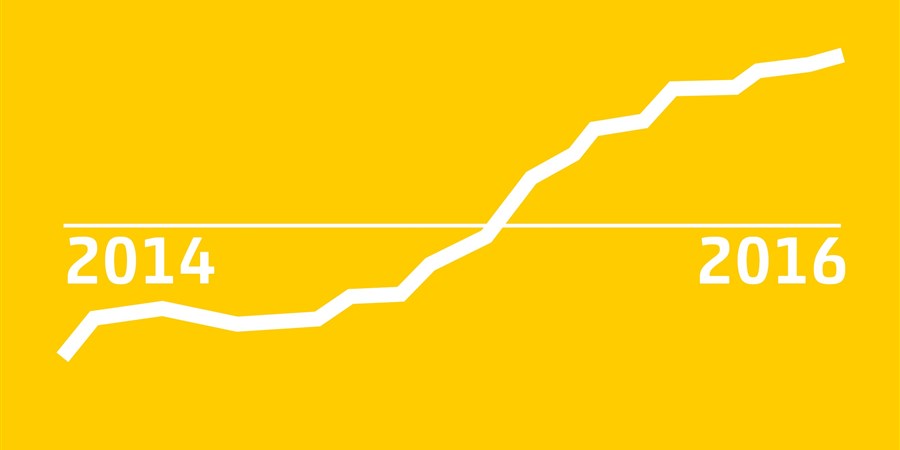

Modest economic growth

Relative to Q4 2015, the Dutch economy continued to grow in Q1 2016. According to a first estimate based on data currently available, growth was 0.5 percent. In this news release Statistics Netherlands (CBS) provides a first picture of the economic situation in the Netherlands. The growth in Q1 is found across the various parts of the economy; consumption, investments and exports all made a positive contribution.

The Dutch economy grew 1.4 percent in Q1 2016 compared to Q1 2015. Economic growth is curbed by the reduced extraction of natural gas.

On Friday 24 June this year, CBS will publish the second estimate on economic growth and employment over Q1 2016.